Mannlowe Ops - Posting US Payment against Sales Invoice (e.g. JSR)

By Tushar Sakhalkar on February 27, 2023

BeginnerCase Details

- Mannlowe India provides services to JSR (CA, USA)

- JSR pays the invoiced amount (e.g. $13,600) though SWIFT

- JSR's bank deducts $38 (say) as bank charges

- Amount in INR is deposited in ICICI Bank at the conversion rate prevailing on the date

- ICICI Bank charges are deducted as separate deductions

Prequisite - Sales Invoice

- A sales invoice with following details is created before hand

- Invoiced Amount - $ 13,600

- Exchange Rate (say) - 81.05

- Hence, Account Receivable created - Rs 11,02,280

Creating Payment

- Create Payment

- Company Bank Account - ICICI-Revenue-ICICI Bank

- Paid Amount - $ 13,562

- Exchange Rate (say) - 82.06

- Paid Amount - 13562*82.06 = 11,12,897.72 (Will appear authomatically)

- Change Received Amount to 11,12,897.72

- Difference Amount will be shown as 13697.62 (in this example) - This is the difference due to exchange rate diffrence NOTE: The amount shown in difference should be entered as it is with sign if negative.

- Go To "Deduction and Losses"

- Choose account as "401000 - Foreign Exchange Gain/Loss - MISPL"

- Enter amount that appears in Difference (e.g.) 13697.62

- Go To "Transaction ID"

- Enter bank transaction details and date of transaction

- Save and Submit

(Follow On) Journal Entry

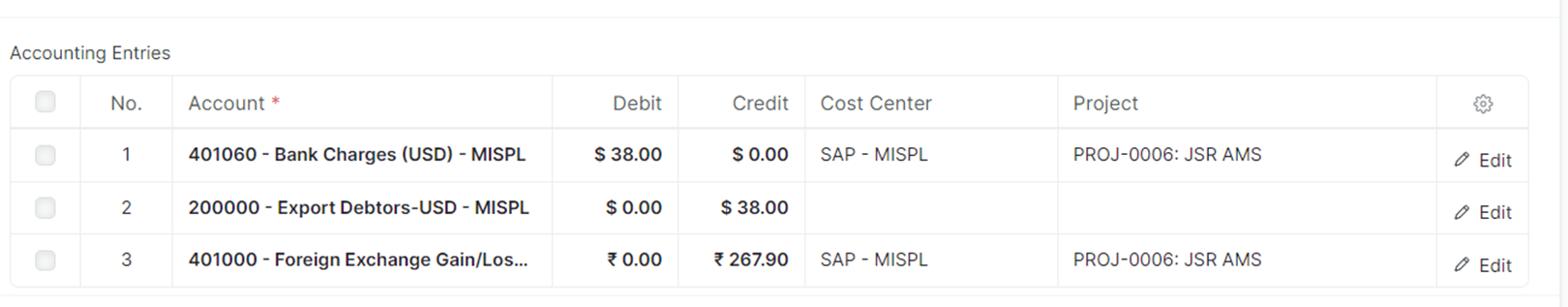

- Create 2 rows of entries

- Click on "Multi Currency" Check box and make 2 entries

| 401060 - Bank Charges (USD) - MISPL | Debit | 38$ |

| 200000 - Export Debtors-USD - MISPL | Credit | 38$ |

- Go to details of 200000 by clicking on "Edit"

- Enter following details

- Party Type - Customer

- Party - JSR

- Reference Type - Sales Invoice

- Reference Name - Choose appropriate Sales Invoice from Drop List

- Go to details of 401060 and change exchange rate to (say) 82.06

- Reference Number and Date

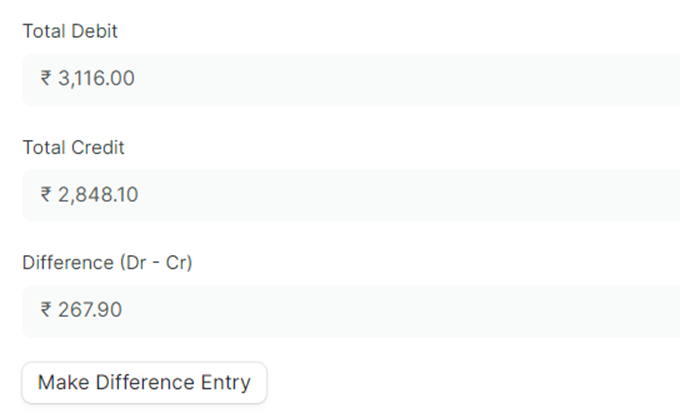

- Difference (e.g. 267.9) will be shown

- Click on "Make Difference Entry"

- 1 Row will get added automatically

- Choose account as "401000 - Foreign Exchange Gain/Loss - MISPL"

- Confirm Cost Center and Project are entered for Bank Charges and Exchange Gain/Loss Account

Was this article helpful?

More articles on ERPNext - Accounting